The Best Ways to Improve Your Credit Score

Are you interested in increasing your credit score? Taking a few easy steps like opening a credit-informing account, maintaining modest balances, and paying your bills on time can help you improve your credit score.

There are many ways to get started, but it can be difficult to figure out where to begin. The following are several ways to make it easier for you to raise your credit score without causing any hassles.

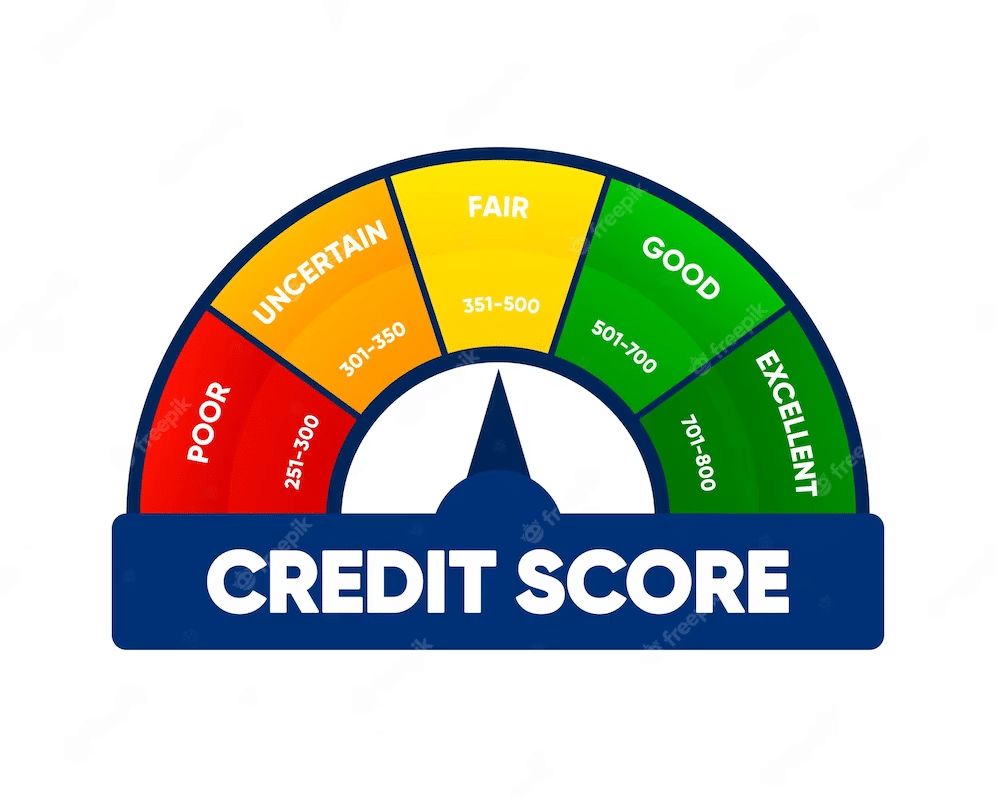

Let’s start by understanding why before we explore how. Having a strong or exceptional credit score could save you a lot of money over the course of your life. Improved credit scores can open up doors to a range of benefits, including lower interest rates on home loans, car loans, and other forms of financing.

In general, better credit scores are associated with lower-risk borrowers, which will lead to more institutions competing for their business or offering better rates, fees, and benefits.

Bad credit customers are seen as higher-risk customers, which leads fewer lenders to give them credit and more companies to charge them excessive annual percentage rates (APRs). Your insurance score may also be effected by a bad credit score, which can make it difficult for you to rent an apartment, rent a car, or even receive life insurance. When it comes to your credit score, you need to be aware of how you’re handling your expenses.

When will your credit score improve?

Credit scores can usually be improved within four to twelve months. It’s your money management habits, including timely payments, a stable income, and a low debt load that determine your credit score. Maintaining consistency in these factors is vital when selecting a credit score.

What is the frequency of checking my credit score?

Check your credit report regularly for errors, but be careful not to hurt your score with too many inquiries. Several banks offer credit monitoring services to all customers, so you may receive alerts whenever your credit score changes. Speak with your bank for more information.

How to increase credit score?

If you’re wondering how to improve your credit score, here’s what you need to know:

Review your credit reports

The importance of being aware of potential favorable factors when trying to fix your credit score cannot be overstated. It can be helpful to monitor your credit history in order to achieve this. Credit scores are influenced by on-time payments, reduced debt balances, credit cards, loans, and previous credit accounts. In any of these situations, you can lose credit score points for failure to pay on time or for lagging behind.

Never miss due payments

Having a long history of on-time payments will help you increase your credit scores, and it is one of the most important factors used to determine your credit scores. The best way to do this is to make sure that you never miss any credit card or loan payments by more than 29 days; credit scores can be damaged by payments that are delayed by at least 30 days. If you don’t mind overdrawing your bank account, setting up automated payments for the minimal amount needed can prevent you from forgetting to pay.

The first thing you should do if you’re having trouble paying a credit card bill is to get in contact with your credit card company as soon as possible. Also keep track of non-regularly reported accounts (such as subscription services and gym memberships) so they don’t affect your credit score.

Consolidate your due payments

In case you have a lot of outstanding bills, it can be beneficial for you to obtain a debt consolidation loan from a credit union or bank and use it to pay them off. Having only one responsibility to worry about will make it easier for you to repay your debt, so if you can get a loan with a low-interest rate, you will be able to pay it off more quickly. In this way, you may be able to raise your credit score and lower your credit utilization ratio. Similar strategies include using a debt transfer credit card to pay off several credit card bills at once.

Take care of the revolving balances

Having a large balance on revolving credit cards will result in a high credit usage rate, and your credit rating will be affected even when you’re not behind on payments. The balance of revolving accounts, such as credit cards or lines of credit, should be kept below the credit limits to improve your credit rating. A credit usage ratio of less than 10% is considered ideal for individuals with excellent credit.

Limit how frequently you apply for new accounts

It is normally a good idea to limit your number of credit applications even though you may be required to open a new account to establish your credit history. A hard inquiry may result in a slight decrease in your scores with each application, but they can accumulate and have a compounding effect as they accumulate. It’s also likely that the average age of your accounts will decline if you open new ones, which will negatively affect your credit scores.

The Bottom Line

As your credit score improves, you will have a better chance of getting approval for new loans and credit lines. Moreover, a higher credit score could help you qualify for the best interest rates when borrowing money. The key to improving your credit scores is to understand how they are calculated and how to raise them, regardless of whether you’re starting from zero or regaining credit.